Maximising your legacy income: Understand your rights and navigate legacy recovery

As a legacy officer, you might encounter challenges when a professional or lay executor becomes unresponsive during the administrative process.

Whether it's due to a Smee and Ford notification and your enquiries are not being acknowledged, an executor going quiet during the administration, or requests for accounts being ignored - it's crucial to know your rights and how to effectively address these situations.

Below we lay out the steps you can take if you are struggling to get a response from an executor.

Understand your rights as a beneficiary

As beneficiaries, it is important to understand that you have rights to information when you have been left a legacy.

Section 25 of the Administration of Estates Act defines the duty of an executor. These duties include:

- Ascertaining the residuary estate and distributing the estate to the proper beneficiaries – as per the Will.

- Providing an inventory and account. An executor must keep estate accounts detailing the assets and liabilities in the estate and the payments to and from the estate.

In our experience, reminding an executor of these rights when they are proving reluctant to give you information can sometimes be enough to prompt the necessary cooperation.

Signpost to the relevant guidance and regulations

The Charity Commission provides specific guidelines that charities must follow:

- CC8 – Internal financial controls for charities: This document has guidance on how to manage your charity’s financial activity and use internal financial controls to reduce the risk of loss.

- The Charities Statement of Recommended Practice (SORP): This provides the guidance that charities should follow when recognising income from legacies.

We often find it is helpful to direct executors to these guidelines and make it clear that legacy officers cannot comply with these requirements if executors don't provide them with the necessary information.

Our approach to unresponsive executors

Despite the backing of these requirements and legislation, some executors may still be unwilling to engage with you.

At Foot Anstey, our team of expert legacy consultants has a tried and tested approach to engaging with executors.

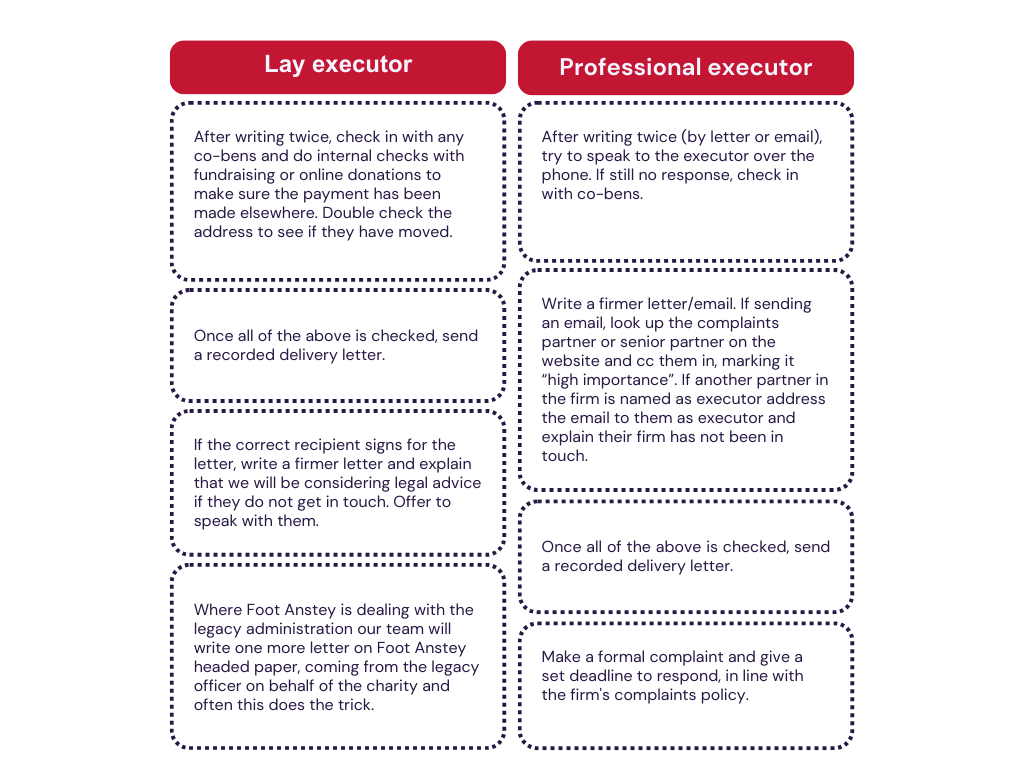

Crucially, we stress the importance of adopting different approaches when communicating with lay individuals versus professional executors.

Approaching lay directors

It is important to be aware of not upsetting the family or friends of the legator as this could risk damaging your relationship with potential donors.

It is also important to consider dates when writing to lay executors, in particular, not writing around the anniversary of the date of death, or the legator's birthday, if known.

Below we set out how we approach lay and professional executors.

If all of the above steps fail, we would then instruct our contentious team to embark upon the legacy recovery process.

We provide a legacy recovery service to charities. We ensure letters are tailored dependent upon on the situation and audience, as well as the charity's internal policies and procedures.

We will shortly be launching a legacy recovery portal which will allow our charity clients to send us instructions, we hope this will help streamline the process for you.

Get in touch

If you have a legacy issue, you need help with, please reach out to our expert team. We are here to help with any queries, whether they relate to property, potential contentious matters, or probate issues.

If you need assistance with an estate, contact our team members, Emma Facey or Jhenna Mortimer.

For more information about our legacy administration services, please reach out to Emma Facey, Nina Sampson, Anisah Ahmad, or Andy Salmons.